Top Facts To Deciding On Gold Bullion Britannia

Wiki Article

What Should I Consider When Investing In Buying Gold Coins/Bullion In Czech Republic?

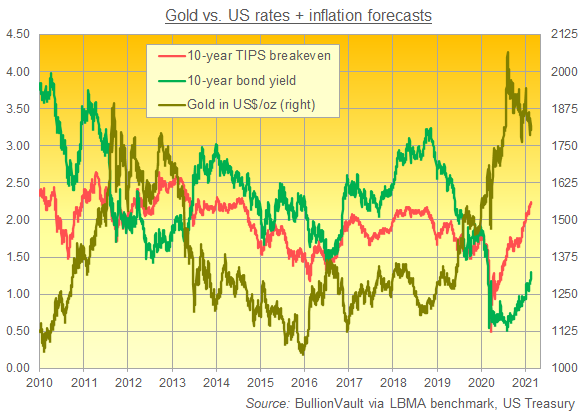

Learn about the tax implications when you purchase and/or sell gold in the Czech Republic. Different tax laws could apply to gold investment, which can influence your earnings. Market Conditions: Monitor market trends and fluctuations in the gold price. This information will allow you to make better informed decisions about the timing of your gold investment.

Authenticity & Certification- Ensure that the bullion and gold coins that you purchase has appropriate certification and documentation to confirm their authenticity.

Set out your investment goals. If you're planning to buy gold, decide if it's to protect your wealth over the long term, portfolio diversification, the hedge against inflation, or to mitigate uncertainty in the economy.

Consultation and Research- Get advice from financial advisors or experts in precious metals investments. Conduct extensive research and learn on the gold market for informed investment decisions.

As you consider your choices for investment, like precious metals, be sure to conduct a thorough study and know your financial goals and your tolerance for risk. See the recommended buy Charles III gold bars for website advice including gold and bullion, 1972 gold dollar, gold ira, 1 ounce gold, buy gold bullion, five dollar gold coin, 1 oz gold eagle, 1 ounce of silver, twenty dollar gold coin, saint gaudens gold coin and more.

How Do I Determine Whether A Gold Product I Purchased Is Authentic And Has The Right Evidence?

To ensure that the gold you purchase comes with the correct evidence and certificates of authenticity, follow these steps

Inquire directly with the seller regarding the paperwork that comes with the gold. Reputable dealers usually provide certificates or assays certificates along with the purchase. For more information, inquire about the documentation. Certificates should include specifics about the gold item, like its quality (in karats or fineness) and weight, as well as the manufacturer's name, hallmark, and any other information pertinent to the purchase.

Check the Certificates - Carefully examine the certificates or other documents accompanied by the gold. Include the information of the seller, date of purchase and any official stamps or seals that prove their authenticity.

Cross-Check the Information- Check the information on the documents against gold itself. Check that the gold item's hallmarks, purity markings or other distinctive characteristics match with the information in the documentation.

Verify the authenticity of the source- check credibility of issuing entity, or the certification authority. Make sure that the assay office is a recognized government institution or reputable certification agency. See the top rated Bohemia coins hints for blog recommendations including 1 ounce gold, gold investment firms, best gold stocks, $50 gold piece, gold buffalo, buying gold bars, 1oz of gold, gold silver investment, price for one ounce of gold, 1 4 ounce gold coin and more.

What Is The Low Price Spread And How Is It A Markup Of The Price Of Gold On The Stock Exchange?

In gold trading, low price markup and spread refer to the cost of buying or selling the gold in comparison to market prices. These terms define how much more you will pay for the gold, whether as a markup or a spread. Low Mark-up - A dealer will charge a minimal premium or cost above the market value of gold. A low mark-up implies that the cost you pay to purchase gold is close to or just a little higher than the current market value.

Low Price Spread - The spread is the difference between buying (bid) and selling (ask) prices for gold. A low spread means there is a small gap between these prices.

How Much Is The Markup And Price Difference Between Gold Dealers Vary?

Negotiability. Some dealers might be more flexible in negotiating markups and spreads. Geographical location - Spreads, marks-ups and local regulations may depend on the regional context. For instance, dealers in areas that have higher taxes or regulatory costs may charge customers for these expenses by charging higher mark-ups.

Product Types The spreads and markups may differ depending on the supply of gold products. Due to their rarity rare and collectible items may be more expensive to mark up.

Market Conditions - During times of high volatility, increased demand, scarcity or market volatility, dealers may raise their spreads to cover or mitigate any losses that could be incurred.

Investors in gold must do their homework to find the top dealer. They must compare multiple prices, consider more than just mark-ups or spreads. Additionally, they must be looking for things like reputation or reliability. They should also consider customer service. Comparing prices and getting quotes from various sources will allow you to find the most affordable prices on gold. View the recommended learn more about buy Charles III gold bars for website tips including gold eagle coin price, 50 dollar gold piece, gold angel coin, gold bullion, barrick gold stocks, 2000 sacagawea dollar, gold silver bullion, gold & silver bullion, gold coin store near me, gold mining stocks and more.